“Everything is very expensive, and people can’t save money”

FTFY

Its a curious state of affairs, because the stock market has been booming all the while.

If you have savings you’re getting enormous passive incomes. 20-30% jumps in accumulated investments annually. If you don’t have savings you’re watching prices skyrocket while salaries flat-line in the face of anti-inflation economic policy.

This does kinda raise the question “Where are equities markets getting all this extra cash from?” And the answer appears to be… its very profitable to charge people more and pay them less.

The stock market is a measure of how much wealth can be extracted from the working class.

It does not measure the health of the economy. That sometimes the market is doing well as the economy is doing well is closer to coincidence than causality.

The fact that the working class can no longer save money, and must spend every dime is great for the stock market. Next they will come for the dollars we have not spent yet. Because mortgages are no longer feasible for most people they’ll have to find new debt traps. Cars will skyrocket in price, you’ll be able to take out a loan to rent an apartment. Student debt will spiral to laughably unrepayable levels.

They’ll take every dime we have, then they’ll take every dime we’ll ever make. And when it gets to the point where there’s no more money to bleed, unless a new source of endless dollars can be found, the market will feed on itself.

If you think peacefully protesting Wall Street is going to fix that, I’ll sell you the Brooklyn bridge.

The stock market is a measure of how much wealth can be extracted from the working class.

I’d argue it goes beyond that. Quite a few ticker symbols on the NYSE are speculative above and beyond anticipated surplus extraction. They’re functionally auction prices on coveted luxuries.

Because mortgages are no longer feasible for most people they’ll have to find new debt traps. Cars will skyrocket in price, you’ll be able to take out a loan to rent an apartment. Student debt will spiral to laughably unrepayable levels.

These have largely come to pass. The “loan to rent” is just your deferred payment on credit card debts to cover rising rental rates.

If you think peacefully protesting Wall Street is going to fix that, I’ll sell you the Brooklyn bridge.

Sure, I can buy it. I just don’t try to cross it for fear the NYPD will arrest me.

stocks are as divorced from actual value now as cryptocurrencies. real estate too. it’s all grift all the time. have a look at the value of djt or tsla, they’re nfts.

it’s all grift all the time.

Its decades of cheap lending to people with all their consumer needs satisfied. If I can borrow at 4% and get 20% ROI, I’m going to borrow every dollar I can get my hands on.

On the flip side, you’ve got private lenders offering double-digit interest rates to the underclass. They’re lucky to get a cost of living increase year over year. So you’re asking people to borrow at 20% with the expectation of a 2-4% ROI.

have a look at the value of djt or tsla, they’re nfts.

DJT is fucking hilarious, because its pure vaporware. But TSLA does actually have factories and vehicle stock and revenue streams and such. Its mismanaged and overvalued, but there’s some amount of there there.

But who is holding Tesla? Vanguard Group, BlackRock, State Street Corp, and Geode Capital Management all have access to the Fed credit window - either directly or through proxies - and can borrow at miniscule rates. They get a positive ROI so long as Tesla appreciates at all. And the long term ROI on an electric car company looks pretty good, even if its overvalued in the short term. So buy buy buy!

We’re in late stage capitalism. Getting rid of the gold standard was one of the biggest mistakes in US history.

I find people who make this “argument” very silly. The gold standard is unsustainable. The amount of cash in circulation will always outstrip the amount of gold in whatever vault it been tied to. Fiat money is always an economic inevitability for a growing state.

The government runs out of money… so it drops the gold standard to “to invigorate the economy”… by taking away value from those that hold cash… which is always the lower class. Higher classes hold assets that dont inflate away.

The problem with this argument is that it neglects the consequence of specie entering and existing the market.

The California and Alaska Gold Rushes did more to devalue the money supply than anything Nixon tried. The Spanish economy of the 1700s imploded in the face of the gold glut it imported from the Incas and Aztecs.

A gold standard doesn’t stabilize the money supply. It simply deflects the question of what that money supply should be onto the private commodity market for gold. But volatility in the gold supply does happen, particularly during times of economic turmoil. And a pegged currency encourages private arbitrage, which increases the frequency of these sharp shifts in gold availability.

And that’s not even getting into what happens when you’ve got a private speculative asset independent of gold - maybe we call it real estate or company stock or cryptocurrency - that siphons off investment dollars one minute and floods the market with currency/commodity-hungry panic sellers the next. Even if you’ve got a stable gold/currency ratio, these aren’t the only two variables in your economic model.

No amount of gold changes the number of potatoes the Irish have to eat.

That’s only true when you are dealing with the infinite growth of capitalism. Nations and empires have used the gold standard for thousands of years. It only became “impossible” when we tried to inflate the value of economies into the stratosphere to enrich the aristocrats of society.

Nations and empires have used the gold standard for thousands of years.

Crack open David Graeber’s “Debt: The First 5000 Years”. He’s an anthropologist who spent his career investigating this theory, and he found it wanting. Hardly the first, but probably a more fun read than Thomas Piketty or Milton Friedman or Adam Smith. Nations and empires didn’t use gold specie until fairly recently in human history. Most of human civilization revolved around different types of credit and debt, typically enumerated in volume of agricultural produce.

Wheat/corn/rice, fish, olive oil, and salt were the most common standards of exchange. Gold was ornamental, but far too little of it existed to circulate as common currency or even reserve currency. It wasn’t until the colonial era and the mass exploitation of Africa, East Asia, and the Americas that European Banks had a large enough surplus gold reserve to treat it as coinage.

So you’re talking at best hundreds of years, and even then only within the handful of European powers capable of plundering the gold reserves of foreign nations on a global scale. And even that only got these countries from the 15th to the 18th century before the system started breaking down.

Ok. Fair. Let me correct myself: money was based on material goods and not rich peoples feefees about the economy.

Definitely closer to the market. Although one major form of historical debt is taxation, and that’s traditionally been subject to how rich people feel about the economy.

The amount of cash in circulation will always outstrip the amount of gold in whatever vault it been tied to.

That’s… the entire fucking point. They printed away our futures, now we suffer.

They printed away our futures

If the amount of potatoes we produce every year goes up and the amount of currency we print every year goes up but the amount of gold we have in our vault stays fixed, the real economy doesn’t care. You’re trading dollars for potatoes and potatoes for dollars. The gold is irrelevant.

But if potatoes go up and currency stays fixed, you have too few dollars chasing too many goods. This deflates the cost of the potato and discourages the next crop. Smaller crops mean food shortages. And food shortages impact social stability. So now you’ve got riots from a food shortage that was created entirely because you didn’t print enough currency to buy up all the potatoes.

Riots from a food shortage because potatoes became too cheap? Funny speculative statement. What about riots because everything is too expensive?

Riots from a food shortage because potatoes became too cheap?

Riots because people stop growing potatoes and start growing bitcoins, in order to chase the highest possible ROI.

What about riots because everything is too expensive?

You’re looking at debt without looking at revenues.

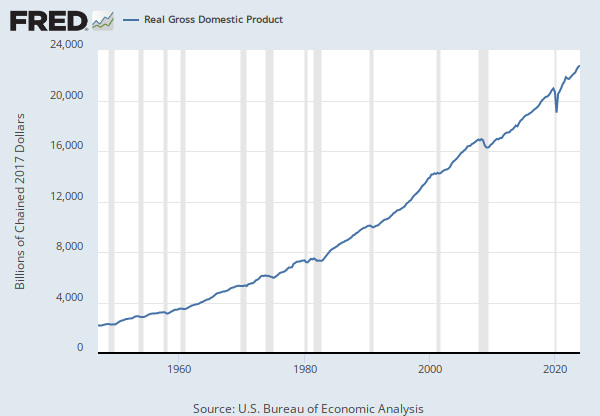

Far worse to owe $10 when you make $10/year than $10M when you make $10M/year. Particularly when I the value of the asset I’ve purchased is rising faster than the debt-rate. Owning a $100M house on a $10M note is an incredibly deal. Public Debt in service of GDP growth is simply investment. And the ROI on that debt has been incredibly good.

laughs in Calvin Coolidge

Yes. YES! Let the Austrian Economics flow through you! Speculation is a consequence of federal monetary policy and commodity inflation. I can’t possibly have anything to do with private credit or free market auction rates.