exactly, the feie makes tax mitigation way simpler for most full-time travelers at most income levels.

you’re welcome, I love it when people find this stuff useful!

exactly, the feie makes tax mitigation way simpler for most full-time travelers at most income levels.

you’re welcome, I love it when people find this stuff useful!

sure, i get it.

he did come up with that half explanation 250 what years ago, so I’ll give him a pass.

kind of a bummer that a half explanation is his most famous 'discovery" even though he did so much

I’m partial to the Newtonian explanation myself, I was explaining my interest the first time I saw an illustration of the Bernoulli principle.

in fact, I just wrote about The Newtonian explanation a few minutes ago:

"the Newtonian makes more practical end complete sense to me sense to me as an explanation for a lift.

maybe the confusion comes from calling the motion of pushing air down “lift”

push-off.

hm. what the heck is an appropriate antonym for lift…

spring-hold.

oh, buoyancy?

maybe we should switch our talk from lift to buoyancy.

rather than generating lift, velocity through the air generates aerodynamic buoyancy due to the increase in downward pressure, or rather the compressed air beneath the airfoil."

yeah, I’m with you, the Newtonian makes more practical end complete sense to me sense to me as an explanation for a lift.

maybe the confusion comes from calling the motion of pushing air down “lift”

push-off.

hm. what the heck is an appropriate antonym for lift…

spring-hold.

oh, buoyancy?

maybe we should switch our talk from lift to buoyancy.

rather than generating lift, velocity through the air generates aerodynamic buoyancy due to the increase in downward pressure, or rather the compressed air beneath the airfoil.

“THAT PLANE JUST CRASHED AND BURST INTO A FIREBALL!!!”

not the controlled landing that I was referring to, but I understand your comparison of the consequences.

“and the ground is 5 feet below you, and you fuck up and drive it 150 feet”

this is my favorite part of your scenario. a pilot literally less than a second from touching the ground glances out the window and thinks " well, just to make sure" and lunges forward, arms outstretched, pushing the joystick completely flat against the console hahaha.

thanks, that’s a good article.

That’s right.

The Foreign Earned Income Exclusion specifically applies to earned income, and does not apply to unearned income.

oh, go on.

i haven’t heard of the updated dynamics of flight.

yes, customs and border protection keeps records of legal entries and exits to and from the US.

why?

I personally think rising is more impressive and spectacular than falling.

“Ok, but realistically…”

The family is more susceptible than you suspect, as well as being under constant and significant duress.

I’m not sure why they would stay dual citizens if their entire purpose is to live in a different country permanently, but:

If, in your situation, the family kept all their money abroad, never reports, uses or transfers a significant amount of that money, waits 40 years, filling falsified us taxes and legitimate South African taxes the entire time, their son also never uses or transfers that money until he begins to launder it through a personal corporation that he has to keep consistent business records for, maintaining fake employees and fake patients false receipts and false invoices, a falsified or real office and equipment that either way he has to pay real rent on, and slowly reintroduces that money back into his “legitimate” accounts, then after half a century and a never-ending amount of effort at maintaining a comprehensive deception while they all continue to fill out their falsified US tax forms and legitimate South African tax forms consistently every year and never using the extranational or laundered money irresponsibly, never make a regular everyday mistake on any tax forms so that the IRS or South Africa performs an audit, and everything else goes right, apparently never live in the US but continue to file US taxes for their entire lives, tax evasion could work for that family and they could “get away with it”.

is it worth it?

I don’t think so. I can’t see any upside to that sort of tax evasion.

“Let’s assume… let’s say…”

Yes, hypothetical and real situations occur because tax evasion seems much easier than it is, the risk seems lower than it is, the effort seems lower than it is, and the reward seems greater than it usually is.

that’s why so many people attempt it. that’s why you don’t report selling a desk on Craigslist.

nobody’s saying that self-reporting is a perfect, foolproof taxation model. it’s a model that does what it’s supposed to. it allows the IRS to function as efficiently and effectively as it currently knows how to.

boy do I agree.

I fly a lot, and I think about this a lot. it’s absolutely nuts.

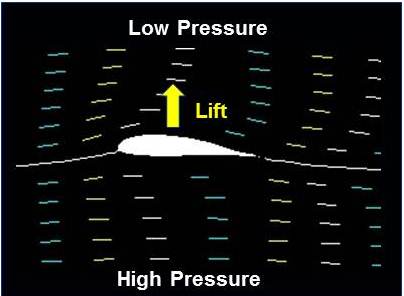

I saw a diagram once explaining how planes fly, this is a good explanation of that:

“Airplane wings are shaped to make air move faster over the top of the wing. When air moves faster, the pressure of the air decreases. So the pressure on the top of the wing is less than the pressure on the bottom of the wing. The difference in pressure creates a force on the wing that lifts the wing up into the air.”

so that’s floating around the back of my mind while I sit in my air chair and think:

"and there we are.

We are climbing into the air again in the big flexible metal tube.

The wings have flex and they almost look like they are flapping in the wind right there.

well, this is crazy again"

approximates my thought process each time I fly.

“Does the IRS have authority to issue such requests to foreign banks?”

issue requests, sure.

and companies with an international presence or countries with a working relationship with the US would be happy to respond to the IRS at least in rough confirmation.

4 out of 5 people in the US would never have to worry about making more than $125 k a year, but if you’re reporting $60,000 annual income and then buying a house every year, the IRS would start looking into it.

irs interest depends on how large the income disparity appears to be before they start officially investigating and probing for more certain corroboration and confirmations.

it’s just like your taxes in the US.

If you have a yard sale and don’t report it, the IRS isn’t going to pay attention to the extra $200 you didn’t report that year unless you happened to sell a personal boat later that year for 200k.

it’s all about what flags the interest of the IRS.

“How would the IRS even know what foreign bank to issue these requests to?”

If you have over 10,000 usd abroad in total, all foreign holdings included, you are required to file what is called an fbar that year, which really is I think five fields on one form, you fill out the name of the Bank, address, the country and the amount.

that’s so the IRS can keep tabs on. approximately how much you’re making versus how much you say you’re making if you’re keeping your savings overseas.

“…gets tracked on a per-individual basis.”

No worries, these are all great questions and I’m treating them like a refresher course.

The IRS is largely dependent on self-reporting whether us citizens or residents are inside or outside of the country, which largely works because maintaining a believable fiction about your income is not easy to consistently pull off and consequences for self-reporting income incorrectly are so much higher than the amount of taxes most people are going to pay that it makes sense to self-report as accurately as you can.

“Still not using that noggin to learn new tricks, eh?”

Don’t feel bad you fell behind, you’re just confused.

I can help you with that, but leading you to comprehension is very much a horse to water situation.

i’m trying to keep these answers as simple and complete as possible for you, so which parts appear to you as “new tricks”?

“If you think that was a…”

is this more of your “not responding”?

you’re not very good at it.

not if you are earning that money while you are outside of the country.

so if you do remote work for a US company that pays money to your us Bank account but you are outside of the country for 330 days, then you don’t pay taxes on the first 125k of your income that year.

here’s how the IRS explains it:

“The source of your earned income is the place where you perform the services for which you receive the income. Foreign earned income is income you receive for performing personal services in a foreign country. Where or how you are paid has no effect on the source of the income. For example, income you receive for work done in France is income from a foreign source even if the income is paid directly to your bank account in the United States and your employer is in New York City.”

Great question!

they wouldn’t know initially.

you report your income, and then if the IRS suspects foul play, they would check later.

If you’re making over 125k, then you’ll likely have some kind of connected web/media presence that would allow them to at least circumstances confirm your position and standing within the field.

they could also check your bank balance and international holdings against the amount you said you’ve been making and see if it matches up.

everyone say goodbye to the wonderful decadess of lean, efficient, bloat-free Windows we have known and loved up until Windows 11!

it’s been smooth sailing until windows 11!